[ad_1]

The crypto marketplace is paying consideration to an enormous Dogecoin (DOGE) transaction. A whale transferred 100 million DOGE, or about $25.42 million, to Binance. The transfer has raised questions on whether or not a sell-off is ready to occur or if that is simply some other conventional shift in holdings.

Whale Job Sparks Issues

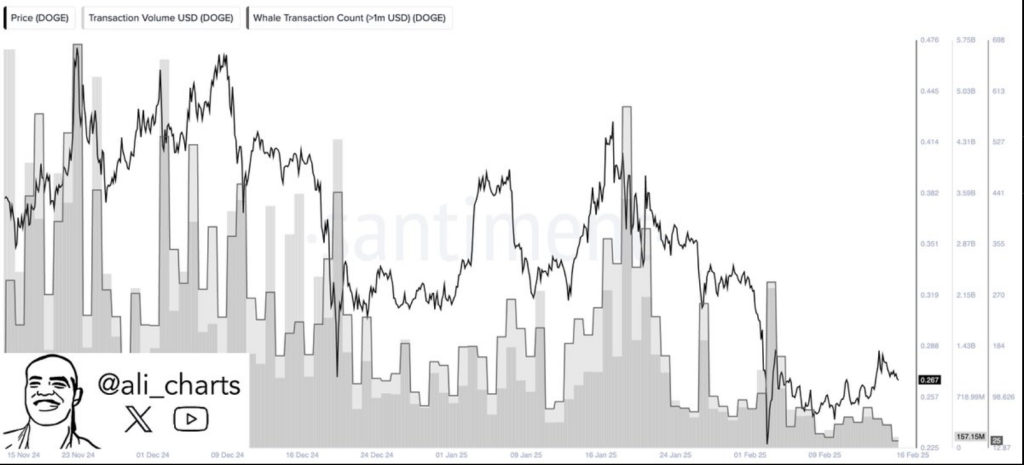

When a big cryptocurrency holder strikes a large quantity in their holdings to an replace, it typically way they need to promote. The cost of DOGE might drop because of this, which might reason smaller traders to react. Alternatively, cryptocurrency professional Ali Martinez famous a decline in whale task general, suggesting that primary traders aren’t appearing aggressively in the intervening time.

Whale task at the #Dogecoin $DOGE community has declined through just about 88% since mid-November! %.twitter.com/6X4CIH3mf8

— Ali (@ali_charts) February 17, 2025

DOGE’s provide marketplace efficiency issues to vagueness. As of the time of writing, the value is $0.255622; an intraday prime is $0.257605 and a low is $0.250725. Those swings suggest a reasonably restricted buying and selling vary; however, if extra important holders make a decision to promote their stocks, volatility may build up.

Marketplace Sentiment Stays Divided

In keeping with positive buyers, the whale switch is a bearish sign, whilst others imagine that its affect is also negligible until an inflow of extra cash happens. Dogecoin has a historical past of reacting sharply to whale actions; then again, the combination promoting power seems to be subdued this time.

The continued dialogue relating to a possible DOGE exchange-traded fund (ETF) is some other major factor that is affecting sentiment. If an ETF acquires momentum, it’ll draw in institutional traders, doubtlessly counteracting any promoting power from whales. However, the marketplace is recently in a state of supposition, as no legitimate approvals or timelines were introduced.

The Street Forward For Dogecoin

In spite of the whale transfer, the cost of DOGE continues to stay secure, but when marketplace sentiment shifts, there generally is a additional drop. Additional dumping might happen if the cost of DOGE drops beneath $0.25, which may additional decrease the associated fee. Then again, sturdy buying task might act as a barrier to additional lower.

Buyers’ Choices

The whale motion reminds us of the rate with which retail business’s marketplace dynamics may shift. Some other people may make a decision to stay their positions since they hope that imaginable catalysts just like the ETF will lift costs, whilst others take a extra wary way, in search of indicators of greater whale task earlier than settling on what to do subsequent.

Featured symbol from Medium, chart from TradingView

[ad_2]

Supply hyperlink