[ad_1]

Este artículo también está disponible en español.

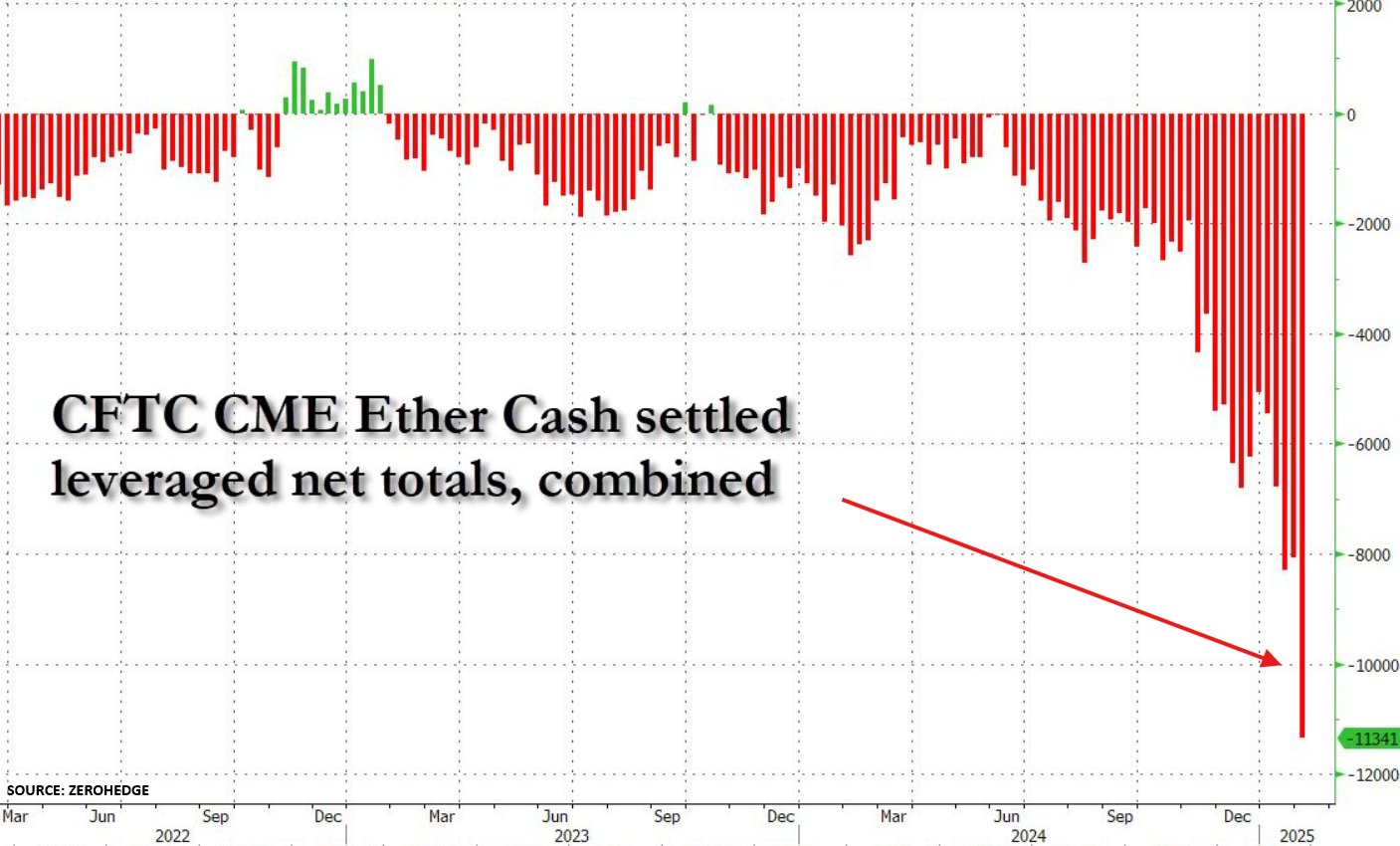

Ethereum (ETH), the second-largest cryptocurrency by way of reported marketplace cap, is dealing with remarkable brief promoting from hedge budget. Particularly, brief positions in ETH have soared by way of 500% since November 2024, indicating heightened bearish sentiment towards the virtual asset.

Institutional Buyers Dropping Religion In Ethereum?

In keeping with a contemporary submit on X by way of The Kobeissi Letter, Ethereum worth is witnessing mounting demanding situations as brief positioning within the cryptocurrency has ballooned in recent years. Particularly, ETH brief positions are up 40% within the remaining week, whilst they’re up 500% within the remaining 3 months.

Supply: Zerohedge

Supply: Zerohedge

It’s value highlighting that that is the easiest degree ever that Wall Boulevard budget had been brief Ethereum. Previous this month, the crypto marketplace were given a sign of this bearish ETH positioning, because the virtual asset crashed 37% in 60 hours amid Donald Trump’s proposed business price lists on Canada, China, and Mexico.

Similar Studying

Curiously, capital inflows to Ethereum exchange-traded budget (ETF) have been considerably prime in December 2024. In simply 3 weeks, ETH ETFs attracted greater than $2 billion in new budget, with a report breaking weekly influx of $854 million.

Then again, hedge budget’ positioning on ETH means that they don’t seem to be very assured within the cryptocurrency’s temporary worth outlook. A number of elements may well be at play for institutional investor’s waning passion in ETH.

For example, ETH is recently buying and selling virtually 45% underneath its present all-time prime (ATH) of $4,878 recorded long ago in November 2021. By contrast, Bitcoin (BTC) has had a stellar 2024, hitting a couple of new ATH, and commanding a marketplace cap this is virtually six occasions higher than that of ETH.

The Kobeissi Letter attributes ETH’s present lacklustre worth efficiency to attainable “marketplace manipulation, innocuous crypto hedges, to bearish outlook on Ethereum itself.” Then again, the marketplace commentator signifies that this over the top bearish outlook might set ETH up for a brief squeeze. They upload:

This excessive positioning manner large swings like the only on February third will likely be extra commonplace. Because the get started of 2024, Bitcoin is up ~12 TIMES up to Ethereum. Is a brief squeeze set to near this hole?

ETH Quick Squeeze To Start up Altseason?

A brief squeeze on ETH may teleport its worth to as prime as $3,000, and even $4,000. Then again, in accordance to seasoned crypto analyst Ali Martinez, ETH should protect the $2,600 strengthen degree to climb upper.

Similar Studying

Fresh stories point out that ETH has most probably bottomed, paving the way in which for a pattern reversal to the upside. Any other document by way of Steno Analysis means that ETH is more likely to outperform BTC in 2025, with attainable objectives as prime as $8,000.

That mentioned, considerations nonetheless stay in regards to the Ethereum Basis often dumping ETH. At press time, ETH trades at $2,661, up 0.1% previously 24 hours.

ETH trades at $2,661 at the day-to-day chart | Supply: ETHUSDT on TradingView.com

ETH trades at $2,661 at the day-to-day chart | Supply: ETHUSDT on TradingView.com

Featured symbol from Unsplash, Charts from X and TradingView.com

[ad_2]

Supply hyperlink