[ad_1]

Este artículo también está disponible en español.

Prior to now few days, Bitcoin (BTC) has withstood two key trends that can have derailed the cryptocurrency’s bullish momentum. Given Bitcoin’s resilience, analysts at the moment are predicting a brand new BTC all-time prime (ATH) within the coming weeks.

Bitcoin Defies DeepSeek Promote-Off, FOMC Uncertainty

Previous this week, US shares took successful after Chinese language AI company DeepSeek unveiled its open-source LLM, elevating issues over the prime marketplace valuation of its American opposite numbers. In consequence, the S&P 500 noticed a robust sell-off, with NVIDIA main the losses, losing 16% in one day.

Comparable Studying

In a similar fashion, in its newest assembly, the Federal Open Marketplace Committee (FOMC) left rates of interest unchanged, consistent with marketplace expectancies. Whilst the hawkish stance used to be anticipated to deal any other blow to crypto markets, BTC remained slightly unscathed after an preliminary dip.

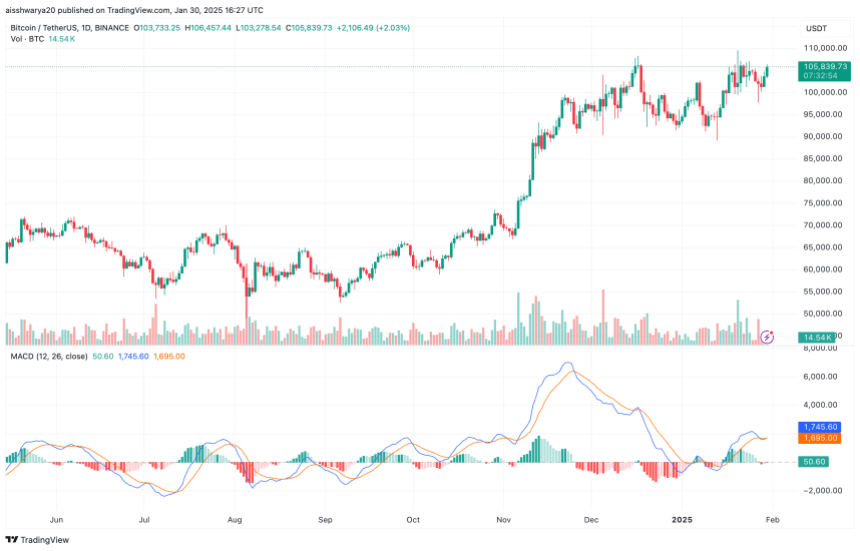

On the time of writing, BTC is buying and selling at $105,839, having necessarily recouped all its losses from the DeepSeek-induced marketplace crash. In reality, BTC has outperformed the S&P 500 over the last 5 days, surging 1.53%, in comparison to the latter’s 1.25% decline.

New BTC ATH In February?

Seasoned crypto dealer Pentoshi commented on BTC’s power, announcing that the virtual asset has held up smartly in spite of the turmoil. The dealer added that they see no reason BTC shouldn’t hit a brand new ATH quickly.

Supply: Pentoshi on X

Supply: Pentoshi on X

Any other Bitcoin fanatic, Castillo Buying and selling, famous that Bitcoin’s value construction “appears to be like flawless.” They added that each lower- and higher-time frames counsel that BTC will most likely pass larger.

Comparable Studying

In a equivalent vein, crypto dealer and entrepreneur Michael van de Poppe mentioned that the marketplace will most likely see a brand new BTC ATH within the ‘coming weeks,’ doubtlessly hinting at February as the objective month.

Additional, crypto dealer Roman shared the next chart, commenting that “Stoch & RSI have quite a lot of room to damage $108,000 resistance and head larger.” They added that bullish divergence on BTC could also be taking part in out well.

Supply: Roman on X

Supply: Roman on X

For the uninitiated, each Stochastic Oscillator (Stoch) and Relative-Energy Index (RSI) are momentum signs that assist buyers establish whether or not the underlying asset is oversold or overbought in present marketplace stipulations.

Whilst projections for a brand new BTC ATH is also centered at the momentary, marketplace cycle peaks are anticipated to happen in the summertime of 2025. As an example, a contemporary file through Bitfinex forecasts that BTC may just surge to $200,000 through mid-2025, amid shallow value pullbacks.

In the meantime DeepSeek predicts that BTC would possibly best out between $500,000 and $600,000 through Q1 2026. At press time, BTC trades at $105,839, up 3.1% up to now 24 hours.

BTC trades at $105,839 at the day-to-day chart | Supply: BTCUSDT on TradingView.com

BTC trades at $105,839 at the day-to-day chart | Supply: BTCUSDT on TradingView.com

Featured symbol from Unsplash, Charts from X and TradingView.com

[ad_2]

Supply hyperlink