[ad_1]

Este artículo también está disponible en español.

In a publish on X revealed the day gone by, Jeff Park, Head of Alpha Methods at Bitwise, mentioned that Bitcoin (BTC) these days gifts a “generational alternative” amid intensifying international macroeconomic turmoil.

Park pointed to elements reminiscent of US President Donald Trump’s proposed business price lists, issues over the USA debt ceiling, and the rising sentiment of deglobalization as key individuals to the present financial uncertainty.

Bitcoin Reigns Perfect Amid International Political And Financial Turmoil

The yr 2025 has began on an volatile footing, marked via emerging international financial and political instability because of business price lists, US debt ceiling problems, and the wider push towards deglobalization. Those elements may just considerably have an effect on monetary markets and geopolitical steadiness.

Similar Studying

Including to the uncertainty is the upcoming expiration of the USA Tax Cuts and Jobs Act (TCJA) later this yr, which might result in exceptional tax coverage shifts and heightened financial unpredictability.

Park additionally underscored the “gold run tail chance,” referencing gold’s excessive value volatility throughout classes of monetary misery. On the time of writing, gold is buying and selling at $2,900 according to ounce, up considerably from round $2,585 in December 2024.

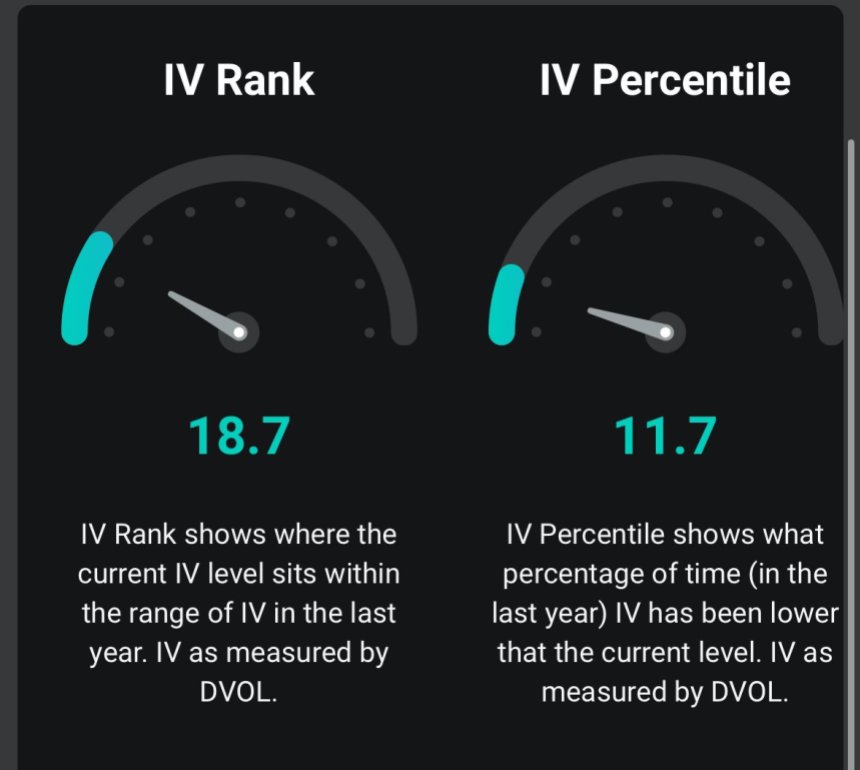

In spite of those mounting dangers, Bitcoin has remained resilient, keeping up a worth vary between $90,000 and $100,000. Park highlighted BTC’s implied volatility (IV) percentile – a measure that displays how its present volatility compares to historic ranges.

Supply: Jeff Park on X

Supply: Jeff Park on X

He famous that BTC’s IV percentile is at its lowest degree of the yr, reinforcing his view that Bitcoin gifts a “generational alternative.” Echoing this sentiment, Bitwise CEO Hunter Horsley remarked that many are underestimating “the large leaps Bitcoin goes to take into the mainstream this yr.”

Certainly, Bitcoin continues to achieve mainstream traction and exhibit resilience amid emerging international financial uncertainty. As an example, BTC remained in large part unaffected via the tech marketplace sell-off caused via the discharge of the Chinese language AI style DeepSeek.

No Altseason Anytime Quickly?

As Bitcoin strengthens its dominance, the altcoin marketplace has struggled, weighed down via skinny liquidity and waning retail passion. One key indicator supporting this development is Bitcoin dominance (BTC.D), which measures BTC’s marketplace cap relative to the entire cryptocurrency marketplace.

Similar Studying

The weekly BTC.D chart displays a robust rebound from round 54% in December 2024. On the time of writing, BTC.D stands at 60.65%, a degree now not noticed since March 2021.

Supply: BTC.D on TradingView.com

Supply: BTC.D on TradingView.com

That stated, some analysts stay positive a couple of possible Ethereum-led (ETH) altseason later in 2025. Contemporary research via Titan of Crypto means that Ethereum is poised for a significant upward transfer this yr.

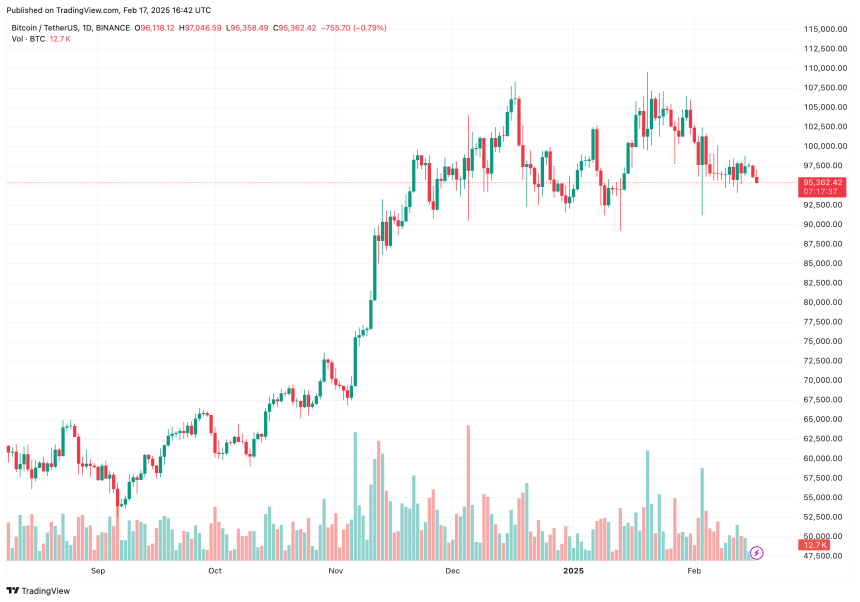

The analyst additionally identified similarities between ETH’s present value motion and BTC’s conduct throughout its 3rd marketplace cycle, implying that Ethereum would possibly quickly input what he calls its “maximum hated rally.” At press time, BTC trades at $95,362, down 0.4% previously 24 hours.

BTC trades at $95,362 at the day by day chart | Supply: BTCUSDT on TradingView.com

BTC trades at $95,362 at the day by day chart | Supply: BTCUSDT on TradingView.com

Featured symbol from Unsplash, Charts from X.com and Tradingview.com

[ad_2]

Supply hyperlink