[ad_1]

Bitcoin has soared previous the $98,000 on Thursday, fueling intense debate amongst buyers over whether or not the $100K milestone is once more inside of succeed in or if the present rally is prone to a swift correction. In the back of the scenes, marketplace observers level to surging open passion (OI) and larger leverage, spotlighting the potential of a leverage-driven push.

Bitcoin Rally Or Lure?

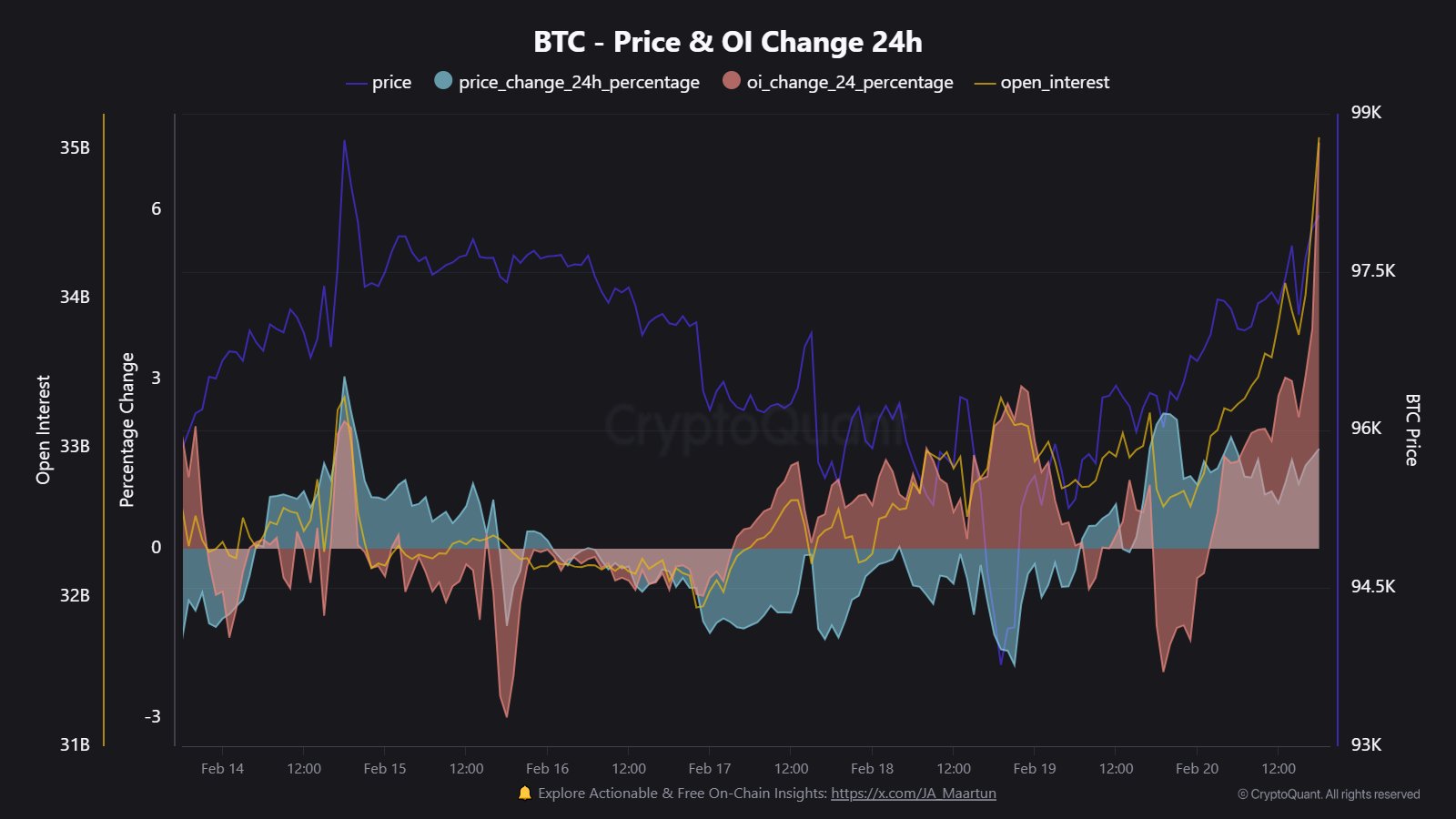

CryptoQuant neighborhood analyst Maartunn (@JA_Maartun) warned of a “leverage pushed pump,” noting a $2.4B bounce in Bitcoin’s OI inside of 24 hours. By way of X, he wrote: “Leverage Pushed Pump: $2.4B (7.2%) building up in Open Pastime in Bitcoin over the last 24 hours.”

Confirming those observations, well known crypto commentator Byzantine Common (@ByzGeneral) highlighted the numerous function of clean lengthy positions in propelling costs upper: “Quite a lot of recent longs coming in right here on BTC which is shoving value upper. Kinda humorous that all the marketplace is getting lifted at this time off the again of those degen longs right here.”

Analysts from alpha dojo (@alphadojo_net) echoed sentiments of warning, underscoring a notable hole between futures-based open passion and spot-driven purchases: “BTC continues to grind upwards, whilst the OI rises frequently, however there may be little spot purchasing. BTC is now drawing near the higher finish of the variety once more. It kind of feels that some marketplace members have attempted to frontrun Saylor‘s deliberate $2 billion bid.”

Even though the chance of a giant purchase may just propel the marketplace, they warn that with out recent catalysts like a “temporary narrative or certain information, it lately looks as if BTC will combat to sustainably pump above the $100k mark.”

Famend crypto analyst Bob Loukas supplied a cyclical framework for decoding Bitcoin’s value actions, noting that the marketplace is also drawing near the tip of 1 multi-week cycle and the beginning of every other: “We’re on verge of finishing a Bitcoin Weekly Cycle, as I’ve been sharing final 6 weeks. For context, there were simply 5 weekly Cycles for the reason that 2022 undergo marketplace lows. (Avg 6month occasions). 4 of those cycles had 90-105% strikes. One didn’t do a lot (June-Sept 23).”

When requested if this alerts an drawing close marketplace most sensible, Loukas clarified:“I’m pronouncing we’re about to start a brand new one. Cycles at all times start from the lows.” His feedback counsel that whilst a cycle transition is drawing close, it does no longer essentially equate to a marketplace height—moderately, it will mark the beginning of a brand new uptrend.

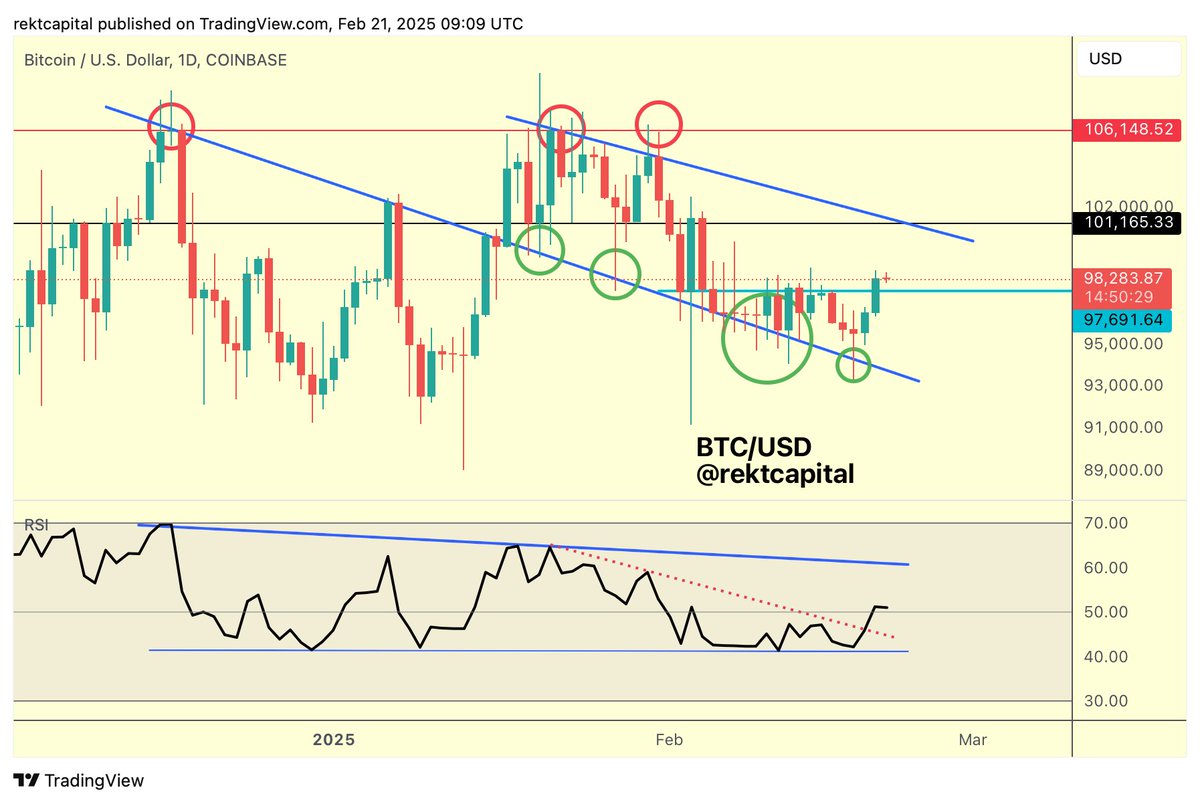

Technical analyst Rekt Capital (@rektcapital) emphasised the importance of Bitcoin’s day-to-day shut above the $97,700 threshold, suggesting {that a} a hit retest of this zone may just pave the best way for a transfer past $100,000: “The early-stage momentum generated through the Bullish Divergence has translated itself into this contemporary breakout transfer. And with the hot Day by day Shut above ~$97700, Bitcoin will now attempt to retest stated stage as enhance to permit pattern continuation.”

He additional elaborated on Bitcoin’s relative energy index (RSI) channel, implying that the smash above a chain of decrease highs would possibly sign the following leg up: “Through the years, Bitcoin’s value persisted to retest the blue trendline as enhance. And the RSI persisted to carry its Channel Backside. In recent times, the RSI broke its collection of Decrease Highs, indicating that the RSI is also able to uptrend to the Channel Best.”

Having a look forward, a transparent retest of $97,700 as enhance may just ascertain Rekt Capital’s bullish outlook: “Day by day Shut above $97700 has been a hit (gentle blue). Any dips into $97700 would represent a retest strive. A post-breakout retest of $97700 into new enhance would totally ascertain the breakout to put BTC for a rally to $101k resistance.”

At press time, BTC traded at $98,645.

[ad_2]

Supply hyperlink