[ad_1]

KEY

TAKEAWAYS

Communique services and products (XLC) claims the highest spot, pushing client discretionary (XLY) to 2d position

Generation (XLK) presentations energy, shifting as much as fourth and displacing industrials (XLI)

Industrials exhibiting weak point, prone to dropping by the wayside of the highest 5

RRG portfolio outperforming SPY benchmark by way of 69 foundation issues

Moving Sands within the Best 5

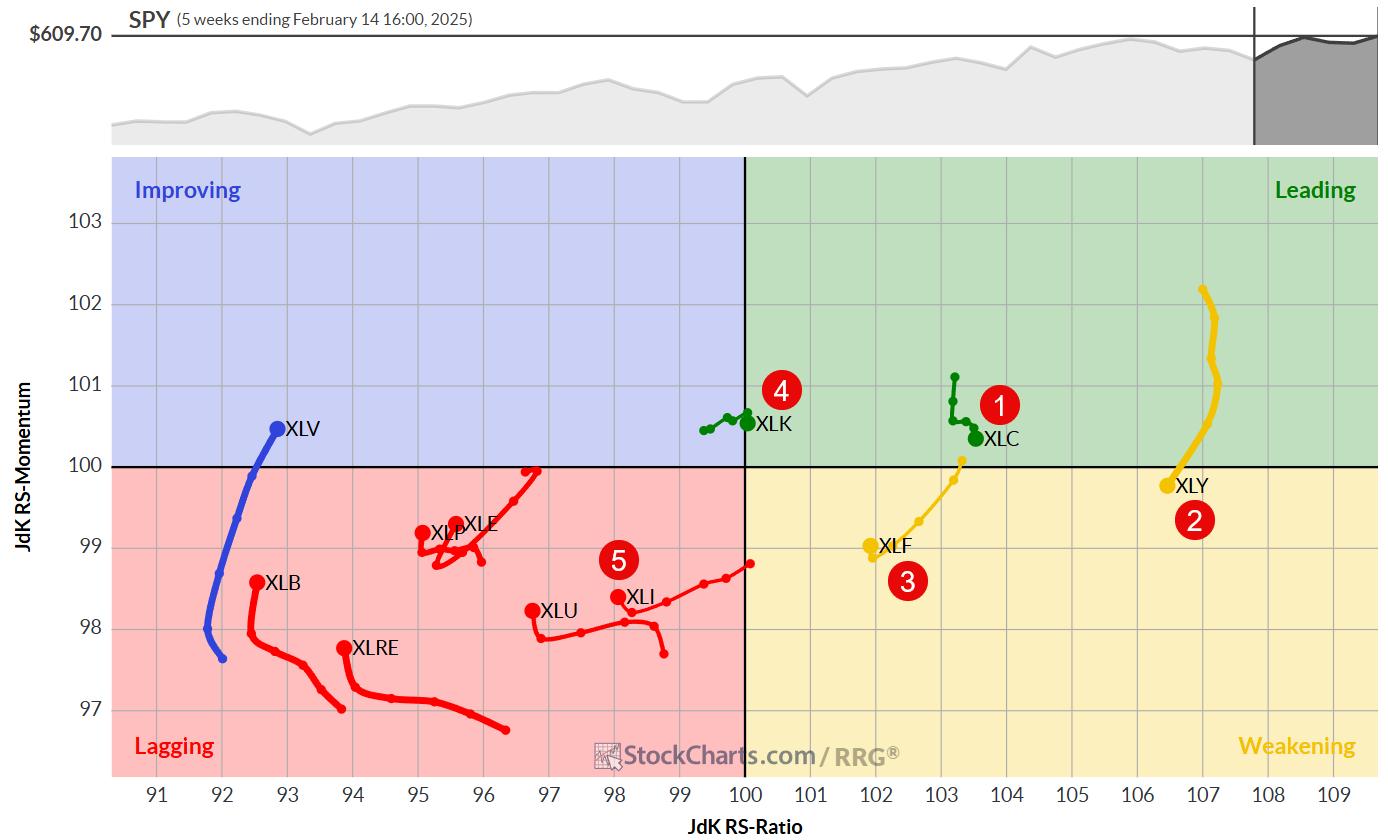

On the finish of ultimate week, there have been some attention-grabbing shifts in sector positioning, regardless that the composition of the highest 5 remained unchanged. Let’s dive into the main points and notice what the Relative Rotation Graphs (RRGs) let us know in regards to the present marketplace dynamics.

On the shut of buying and selling on Valentine’s Day (February 14th), we noticed a little bit of a love-hate courting taking part in out a number of the sectors. This is how they stacked up:

(3) Communique Services and products – (XLC)*(1) Shopper Discretionary – (XLY)*(2) Financials – (XLF)*(5) Generation – (XLK)*(4) Industrials – (XLI)*(6) Utilities – (XLU)(7) Shopper Staples – (XLP)(9) Actual Property – (XLRE)*(10) Power – (XLE)*(8) Well being Care – (XLV)*(11) Fabrics – (XLB)

Communique Services and products took the highest spot from Shopper Discretionary, pushing that sector all the way down to #2 and Financials all the way down to #3. Generation and Industrials swapped puts 4 and 5.

We additionally noticed some reshuffling within the backside part of the rating. Utilities (XLU) held stable, whilst Shopper Staples (XLP) maintained its #7 spot. Actual Property (XLRE) and Power (XLE) each and every climbed a rung, touchdown at #8 and #9, respectively. Well being Care (XLV) tumbled from #8 to #10, and Fabrics (XLB) remained firmly planted within the basement at #11.

Weekly RRG: A Acquainted Image

The weekly RRG paints a identical image to ultimate week, with a couple of notable tendencies:

Shopper Discretionary nonetheless has the perfect studying however is heading south throughout the main quadrant. Communique Services and products is dropping some momentum however keeping up its relative energy. In spite of being within the weakening quadrant, Financials has hooked again up—a favorable signal. Generation is nearly desk bound, teetering at the fringe of making improvements to and main.

In all probability probably the most intriguing motion is occurring within the lagging quadrant, the place maximum tails hook up moderately. Whilst no longer all have accomplished a favorable heading but, it is a signal of doable growth at the horizon.

Well being Care is the lone wolf within the making improvements to quadrant, a favorable building. Alternatively, its low studying at the JdK RS-Ratio scale suggests it nonetheless has some paintings.

Day by day RRG: Tech’s Time to Shine?

Switching gears to the day by day RRG, we get a clearer image of why some sectors are jockeying for place:

Generation flexes muscle groups with a robust, lengthy tail within the making improvements to quadrant.

Shopper Discretionary is heading in the wrong way, shifting into lagging territory.

Communique Services and products is keeping onto its relative energy in spite of dropping some momentum.

Financials, Well being Care, and Fabrics are all within the lagging quadrant with detrimental headings.

Utilities are appearing obvious energy, shifting into the main quadrant with gusto.

Highlight at the Best 5

Let’s get into the trenches and read about each and every of our height performers:

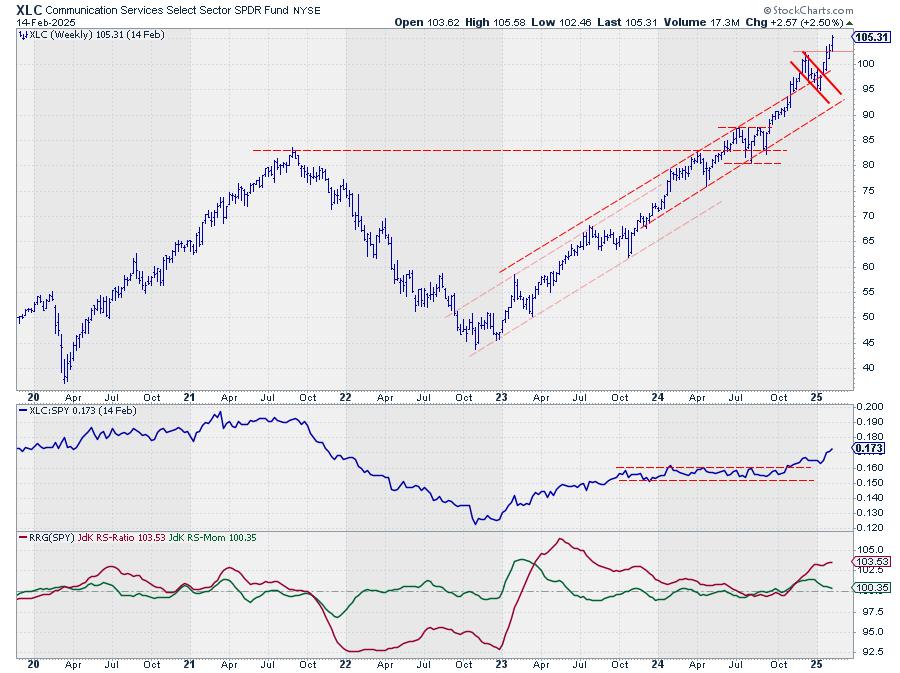

Communique Services and products (XLC)

XLC is satisfying expectancies by way of rising from its flag consolidation development and shifting against new all-time highs. Additionally it is bettering its status on value and relative charts, which can be bullish signs of the field’s ongoing supremacy.

Shopper Discretionary (XLY)

XLY is indicating some relating to traits. It has established a imaginable double height, which shall be validated if the cost falls underneath $218, the low from 5 weeks in the past. The relative energy line mirrors this formation, and the RRG traces are declining. Taking into account its previous energy, a notable decline would possibly take a little time to materialize, however it’s surely one to observe intently.

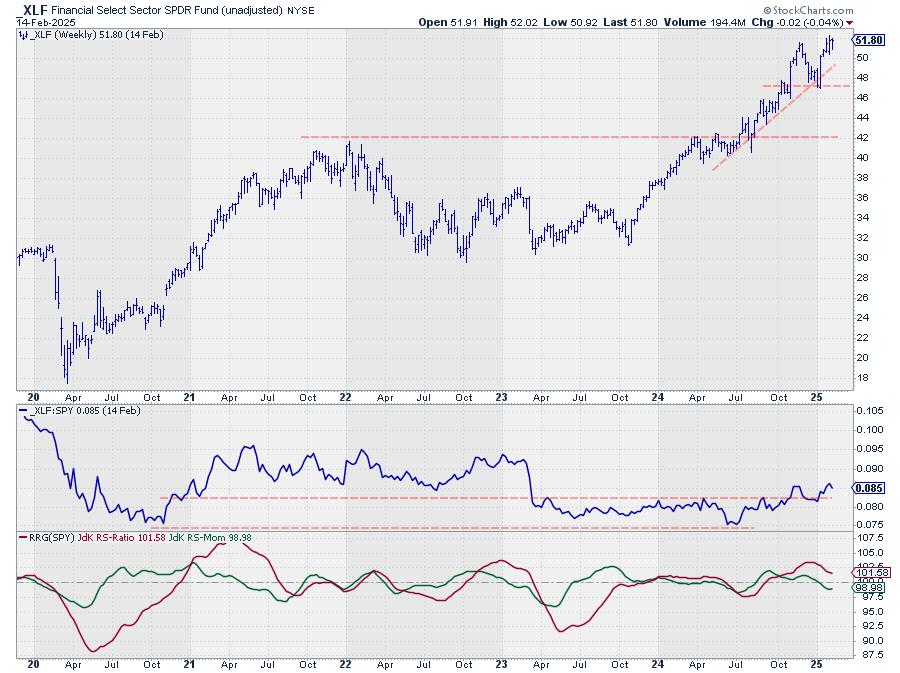

Financials (XLF)

Financials are keeping their flooring admirably. Closing week noticed a ruin above the former prime on a last foundation — one thing that did not occur within the two weeks prior. The uncooked RS line additionally pushes in opposition to (and most likely above) its earlier prime. If this growth continues, be expecting Financials to handle its top-five standing.

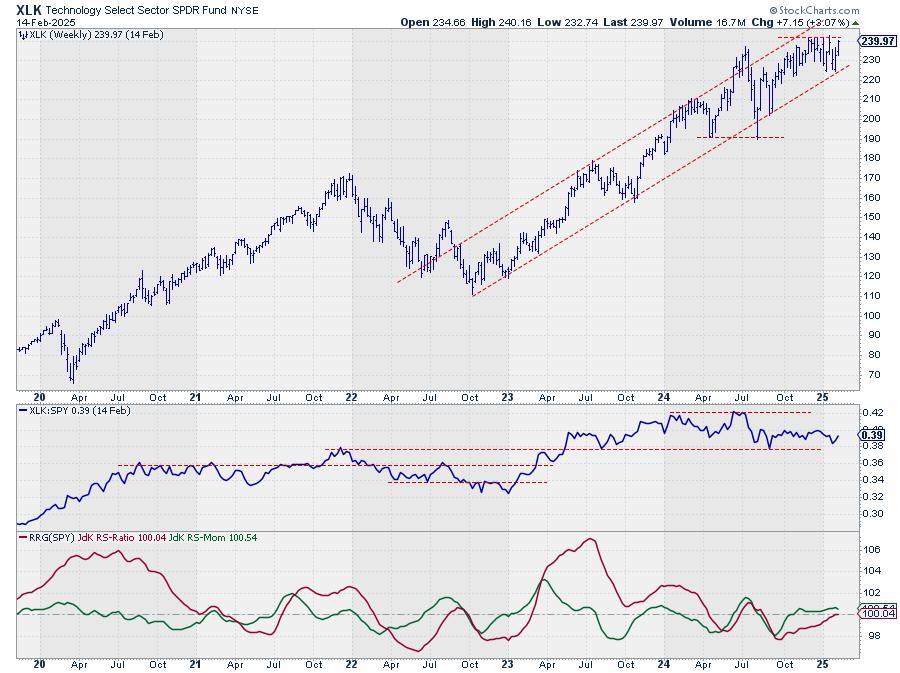

Generation (XLK)

Tech is coming round again, overtaking Industrials for the #4 spot. Value-wise, we are nonetheless grappling with overhead resistance round $242, however we closed on the week’s prime — a favorable signal. The relative energy is shifting upper off the decrease boundary, and RRG traces proceed to climb (with a slight dip in momentum). I am retaining an in depth eye on that $242 stage — a ruin above may sign the beginning of a brand new leg up for the field.

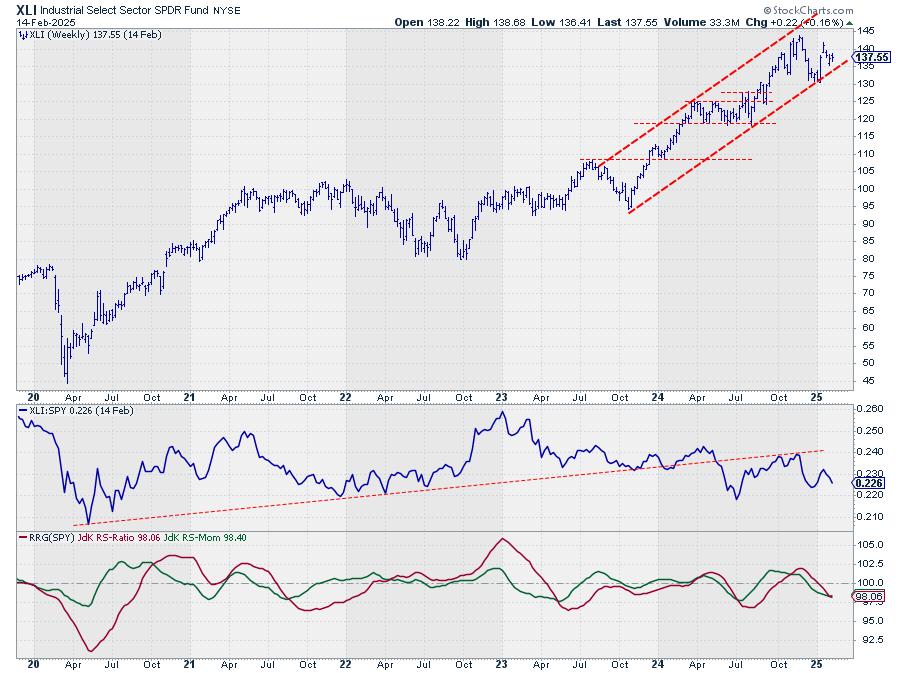

Industrials (XLI)

Industrials reside as much as our expectancies because the weakest hyperlink within the height 5. It is dropped from #4 to #5, due to endured weak point in relative energy. The RRG traces level decrease, suggesting it is only a question of time prior to XLI drops out of the highest 5. Value-wise, we are nonetheless inside the emerging channel, however a decrease prime has shaped — no longer a super signal. Strengthen is available in round $134 (emerging enhance line) and $132-130 (overdue December low). A ruin underneath those ranges may cause a extra vital decline.

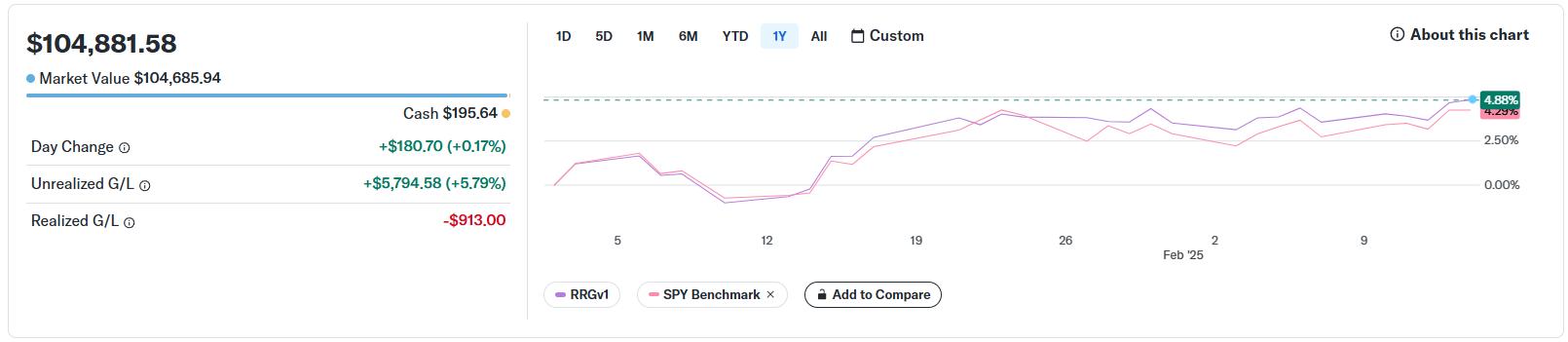

Portfolio Efficiency Replace

In spite of the converting stipulations, our RRG portfolio stays tough. Since its inception, it has accomplished a 4.88% achieve, whilst the SPY benchmark has simplest greater by way of 4.29%, leading to an outperformance of 59 foundation issues.

#StayAlert and experience your lengthy weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Writer, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please in finding my handles for social media channels beneath the Bio underneath.

Comments, feedback or questions are welcome at Juliusdk@stockcharts.com. I will not promise to answer each message, however I can surely learn them and, the place moderately imaginable, use the comments and feedback or solution questions.

To speak about RRG with me on S.C.A.N., tag me the use of the care for Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Concerning the creator:

Julius de Kempenaer is the writer of Relative Rotation Graphs™. This distinctive strategy to visualize relative energy inside of a universe of securities used to be first introduced on Bloomberg skilled services and products terminals in January of 2011 and used to be launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in more than one officer ranks. He retired from the army as a captain in 1990 to go into the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be informed Extra

[ad_2]

Supply hyperlink