[ad_1]

For us at EarningsBeats.com, profits season is the time to do our analysis to discover the most productive shares to business over the following 90 days, or profits cycle. We do that in more than a few techniques. Our flagship ChartList is our Sturdy Income ChartList (SECL), which truthfully is not anything greater than a complicated WatchList that organizes annotated charts with key value/hole enhance ranges, merely as a reminder all the way through the following quarter as to the place could be nice access issues. Those shares most often have nice value/quantity combos, superb relative energy, and emerging AD traces (accumulation/distribution traces).

These days, we’ve got 301 shares on our SECL and all of our prior Style and Competitive portfolio shares had been in this ChartList. Some of the keys is that SECL firms ALL have crushed Wall Boulevard consensus estimates as to each revenues and profits in step with percentage (EPS). It promises us a component of robust basics and showed control execution, I consider vital elements to long-term expansion.

On Monday, we will be unveiling the ten equal-weighted shares in our Style and Competitive Portfolios for the following 3 months. However earlier than we announce the ones shares, a lot research must be performed. For functions of this text, I will provide you with a pair names that I am taking into consideration strongly for certainly one of our portfolios, primarily based upon their quarterly effects and their technical outlook.

Samsara, Inc. (IOT)

There are many shares to choose between in tool ($DJUSSW), so IOT would possibly or won’t make our ultimate lower. Alternatively, the energy right here, each absolute and relative, is plain. We simply noticed each absolutely the and relative value get away to all-time highs. So too did the AD line. The uptrend is alive and kicking, if now not strengthening. IOT can be reporting its quarterly effects on March sixth, which is just a couple weeks after our portfolio “draft”. Having profits so shut could be a in reality excellent factor or a in reality dangerous factor. These days, IOT’s important relative energy vs. tool suggests to me that the newest quarter has been an overly sturdy one, which might propel IOT considerably upper in no time when effects are launched, serving to to steer a portfolio upper. However what if IOT misses its estimates or lowers long run steering? Now we have a historical past of protecting our portfolio shares for a complete 90-day length with out stops. After all, our EB participants can make a decision on their very own methods to care for each gaps to the upside or to the drawback on account of quarterly effects. However protecting a inventory for 90 days after reducing steering will also be unhealthy.

For our subsequent attainable portfolio inventory, how a few family title that consolidated for 2 years earlier than breaking out, then pulled again to check that key enhance stage?

Coca Cola Co. (KO)

Strangely, KO beat its most up-to-date quarterly income consensus estimate via 8-9% and simply surpassed its EPS estimate as smartly. May just this be a gentle affect for a portfolio for the following 90 days? Must we believe that KO’s easiest two-consecutive-calendar-month length during the last twenty years is March and April?

There will be so much to take into consideration over the following 24 hours as we get ready to unlock our portfolio choices. Are we able to repeat our stellar result of the closing couple quarters? Take a look at this out:

Style Portfolio:

For the length November 19 thru Friday, February 14th’s shut:

Style Portfolio: +15.15percentS&P 500: +3.34%

For the length August 19 thru November 19:

Style Portfolio: +20.89percentS&P 500: +5.50%

Competitive Portfolio:

For the length November 19 thru Friday, February 14th’s shut:

Competitive Portfolio: +9.37percentS&P 500: +3.34%

For the length August 19 thru November 19:

Competitive Portfolio: +25.75percentS&P 500: +5.50%

That is unreal outperformance, particularly while you believe that those are quarterly effects! Any portfolio arrange would really like to overcome the benchmark S&P 500 via 1 share level every year. Each our Style and Competitive portfolios have crushed that benchmark via greater than 25 share issues during the last 6 months.

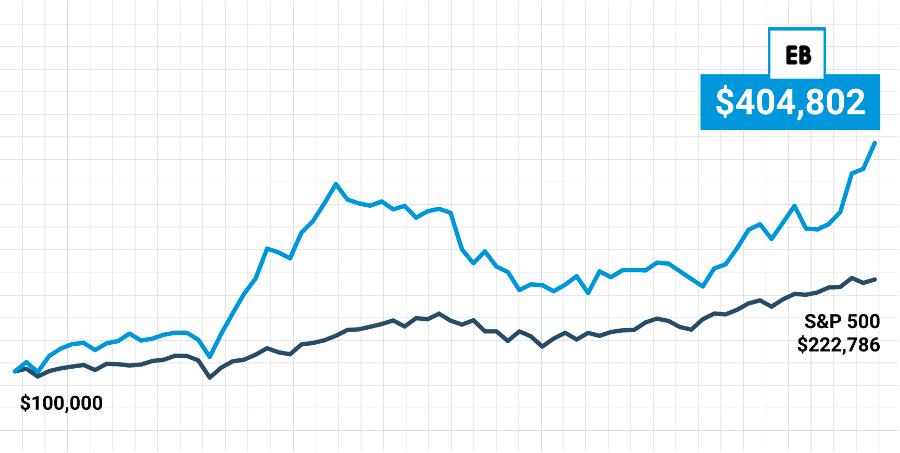

I confirmed our “since inception” Style Portfolio effects vs. the S&P 500 in a graph in the day past’s article, however it is value repeating:

That is numerous outperformance during the last 6+ years. And we are going to check out to do it once more. We are “drafting” the ten equal-weighted shares in our portfolios on Monday, February seventeenth at 5:30pm ET. It is a members-only match, however we do have a 30-day FREE trial for the ones fascinated by testing our technique. For more info concerning the match and club, click on HERE.

Glad buying and selling!

Tom

Concerning the writer:

Tom Bowley is the Leader Marketplace Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding execs and person traders. Tom writes a complete Day-to-day Marketplace Record (DMR), offering steering to EB.com participants each day that the inventory marketplace is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as smartly, mixing a novel ability set to manner the U.S. inventory marketplace.

Be told Extra

[ad_2]

Supply hyperlink