[ad_1]

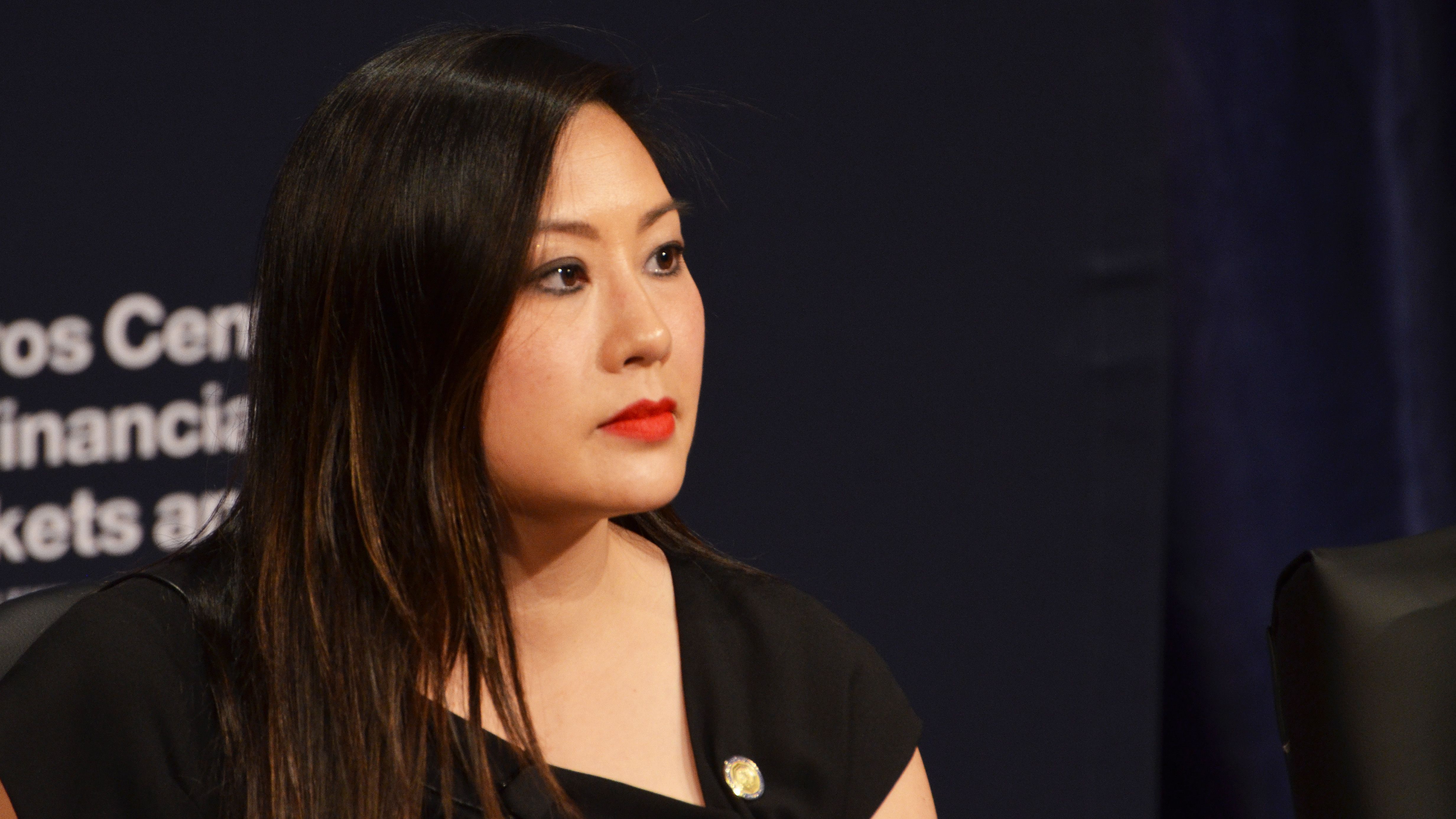

The U.S. Commodity Futures Buying and selling Fee’s prison marketing campaign towards prediction marketplace platforms akin to Polymarket and Kalshi can not simply be close down, in line with Caroline Pham, the performing company chairman installed position by way of President Donald Trump.

Pham stated the company will accumulate mavens for a roundtable assembly, most probably subsequent month, that may construct a case for the way the fee should manner legislation and oversight of corporations that supply having a bet on tournament contracts. She famous that regardless of her persisted objections in recent times to former Chairman Rostin Behnam’s enforcement stance towards prediction markets — together with wagers made on carrying occasions and U.S. political results — the company moved too a long way on its trail to simply opposite it.

“Sadly, the undue lengthen and anti-innovation insurance policies of the previous a number of years have critically limited the CFTC’s talent to pivot to commonsense legislation of prediction markets,” Pham stated. “The present fee interpretations relating to tournament contracts are a sinkhole of prison uncertainty and an beside the point constraint at the new management.”

Putting in the roundtable is a “vital first step with the intention to identify a holistic regulatory framework that can each foster thriving prediction markets and offer protection to retail shoppers from binary choices fraud akin to misleading and abusive advertising and marketing and gross sales practices,” Pham stated.

The CFTC misplaced an preliminary courtroom case towards Kalshi when a U.S. federal pass judgement on dominated past due closing yr that the company could not prevent the company from list election contracts. Alternatively, the company pursued an attraction with a better courtroom, and Kalshi argued in that new prison dispute that best Congress can halt election having a bet.

Learn Extra: CFTC Fines Crypto Having a bet Carrier Polymarket $1.4M for Unregistered Swaps

The CFTC had taken a place via laws, orders and enforcement paintings that such political having a bet is not authorized below derivatives regulations and that the company does not be capable to police manipulation of the ones markets — principally arguing that it will need to be an elections cop. With best days last in his chairmanship, Behnam’s company was once in quest of details about Polymarket’s shoppers from crypto change Coinbase.

In language that is a pointy distinction from Behnam’s resistance, Pham referred to as prediction markets “the most important new frontier in harnessing the ability of markets to evaluate sentiment to resolve possibilities that may convey reality to the Knowledge Age.” She added the company must “damage with its previous hostility.”

Learn Extra: Polymarket’s Buyer Knowledge Sought by way of CFTC Subpoena of Coinbase, Supply Says

Pham is working the company within the absence of Trump naming an everlasting nominee to hunt Senate affirmation to take over. Thus far, the president has best picked a head for its cousin regulator, the Securities and Change Fee. Such confirmations can take months, so whether or not or now not Pham turns into a pacesetter for the everlasting process, she’ll have time to perform some coverage targets on the CFTC.

[ad_2]

Supply hyperlink